By Tom Travis

The Flint City Council has approved an embattled resolution for the city to release the 350-acre former Buick City brownfield to developer Ashley Capital.

Ashley Capital is under contract to purchase the site from Revitalizing Auto Communities Environmental Response (RACER) Trust. Ashley officials plan to develop a state-of-the-art industrial park expected to bring about 3,000 jobs to the City of Flint — jobs paying upwards of $17 per hour. The company plans to invest about $300 million in the site, pending a period of due diligence that is expected to end in 2023, according to Ashley Capital.

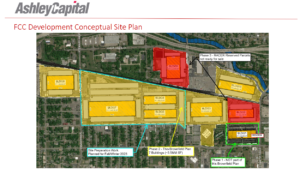

Ashley Capital’s map of the Buick City Redevelopment (Graphic submitted by Ashley Capital)

Funding for the massive redevelopment is being funded with $3.25 million from the City of Flint ARPA funds (leveraged at a rate of about 4:1), $2 million from the C.S. Mott Foundation, $3.25 million from the Genesee County ARPA funds, $8.5 million from the Michigan Strategic Fund (MSF).

The City Council vote came after hours of debate during a council meeting. The debate among council members and members of the public was in part about a complex financial arrangement in which future property taxes are captured and used for the development of the property.

Voting ‘yes’ were Councilpersons Ladel Lewis (Ward2), Quincy Murphy (Ward 3), Judy Priestley (Ward 4), Candace Mushatt (Ward 7) and Eva Worthing (Ward 9); Tonya Burns (Ward 6), Jerri Winfrey-Carter (Ward 5) and Dennis Pfeiffer (Ward 8) abstained their vote. Councilperson Eric Mays (Ward 1) did not vote because he is currently suspended for 30-days.

What is a (TIF) Tax Increment Financing?

A critical and complex component of a redevelopment is the financing of the project. The Buick City redevelopment project uses a financing mechanism called a TIF (Tax Increment Financing). TIFs, were created by the federal government in the 1950s and are used widely across the nation in redevelopment projects. In 1996, Michigan passed Act 381 to create the Brownfield Plan mechanism to facilitate the redevelopment of blighted and contaminated land. Brownfield Plan TIFs are the most common tool in Michigan to support redevelopment projects.

Originally the TIF mechanism was a way to finance the redevelopment of blighted areas. But the TIF mechanism has morphed into a more complex financing option that allows developers to use estimated future property taxes for the development of the property over a period of time, capped at 30 years.

For the Buick City redevelopment, Ashley Capital has built an 80/20 model to follow for the capturing of new property tax. The new taxes created by the development are considered the “tax increment.” The 80/20 model would allow for 80 percent of the tax increment to be reimbursed to the developer for pre-approved redevelopment expenditures. The baseline taxes being paid on the value of the property before the development would continue to be collected by the normal taxing jurisdictions (city, county, state).

The remaining 20 percent is considered the “pass-through.” The 20 percent will be distributed through normal taxing jurisdictions (city, county and state). Throughout the discussions of this resolution Ashley Capital has stated the 20 percent will provide immediate tax benefit to the city from the new development. The assumed project buildout period is about 16 years with a new building constructed approximately every two years. This assumption is subject to market conditions.

Councilpersons Winfrey-Carter and Burns, along with many members of the public, continually called for a different percentage breakdown including a 50/50 proposal.

Mark Quimby of Ashley Capital told EVM that most of their projects using TIF financing are 100/0 or 90/10. Quimby explained the 80/20 model is often used in especially economically challenged municipalities.

In the two-phase redevelopment ,new taxes are captured only in the second phase. The redevelopment is still in phase one and the current taxes due on the Buick City property is $4,000. Portions of the $4,000 will be divided between the city, county and state. Ashley Capital is preparing to build the walls of their first new building on the site. Quimby said that the city assessor has told him the new tax on the property, with one new building, will be estimated at $430,000.

Mark Quimby of Ashley Capital presenting the Buick City Redevelopment plan at a June 2023 council meeting. (Photo by Tom Travis)

The chart below, provided by Ashley Capital, shows the growing tax base for the city of Flint over the next 25 years. The amount of new tax for the city will grow to over $2.5 million over the next two decades. After the 25 year development Flint will receive 100 percent of the tax. According to the chart that new tax amount will be upwards of $8 million.

The complex financial mechanisms used in the brownfield redevelopment has created confusion and angst among members of the public and city council members. Quimby explains why Ashley Capital chose to have this redevelopment TIF to be an 80/20. Ashley Capital has only one other 80/20 TIF project, in Hazel Park. Most of Ashley Capital other redevelopment projects in Michigan are 100 percent. The 20 percent will go directly into the City of Flint coffers.

Developer Ashley Capital has provided an 18-page document detailing the redevelopment project which can be viewed below.

Who is Ashley Capital?

Ashley Capital specializes in brownfield redevelopment and has worked with RACER Trust to redevelop multiple former GM sites in Michigan, like the 120-acre GM Delco Plant in Livonia. In other nearby actions, Ashley Capital brought Amazon Inc. and Republic National Distribution Co. to the Livonia site.

The former Buick City property (Photo by Tom Travis)

Buick City is a former automotive manufacturing site in Flint that the General Motors Corporation used throughout the late 20th century to manufacture transmission and engine components until it ceased operations in 2010.

The 413-acre Buick City site is an industrial brownfield which once boasted 30,000 employees in 24 buildings — making it one of the largest manufacturing facilities in the world. In its last years before it shut down entirely in 2010, it was the primary producer of the Pontiac Bonneville and Buick LeSabre.

More information on RACER Trusts’ responsibilities and expectations from Michigan’s Department of Environment, Great Lakes and Energy can be found here.

What is a TIF? Tax Increment Financing explained

Prior to development, very few property taxes are typically generated from the brownfield sites. After completion of the redevelopment, the property value increases, and the developer pays the higher taxes. The difference between the taxes generated before and after development are eligible for “capture” to be used to reimburse the developer for pre-approved eligible costs.

Any reimbursements the developer may have will have to be submitted to the Brownfield Redevelopment Authority whose members include: Derwin S. Monroe, Gregory Viener, Richard L. King, MArsay Wells-Strozier, Maurice Davis, Martin Banks and Karen Vance according to an email from the City’s Communication Director Caitie O’Neill.

Some of the eligible costs allowed for reimbursement by the developer include, according to Ashley Capital:

- Removal of existing slabs, foundations and utilities

- new sewers, constructed of chemically resistant materials and sealed to prevent infiltration of contaminated groundwater

- management of contaminated soil and groundwater generated during construction

- installation vapor barriers in new buildings

- environmental oversight during construction

- site preparation activities such as mass grading because the property is flat

- placement of geopiers to support foundations due to poor soil conditions

- importing soil to raise site grades

Only eligible expenses defined by the EGLE (Department of Environment, Great Lakes and Energy) (environmental) and MEDC/MSF (Michigan Economic Development Corporation) (non-environmental) can be reimbursed. The developer takes the risk to fund the project, including both eligible and not eligible activities, up front. After receiving a property tax payments (twice per year), the incremental taxes paid are remitted back to the developer by the City Brownfield Redevelopment Authority.

The city is not at risk financially because the developer is only reimbursed from the taxes it pays and only if it incurred the eligible costs. Local schools lose no tax dollars; the State reimburses lost revenue from general fund, according to the Ashley Capital explanation

For the Buick City Redevelopment project there are two phases. Presently it is in Phase One. which does note allow for reimbursement of eligible activities and no taxes are captured for the developer. In Phase Two, however, estimated eligible activities will equal $72.5 million including 15 percent contingency allowed by statue. This does not include the $17 million in city, county and state funding. The total estimated cost of $89.5 million reduced by this amount. Also during Phase Two 80 percent of incremental taxes will be captured. A usual practice nationally is to capture 100 percent.

Councilpersons Priestley and Pfeiffer comments

Flint City Councilperson and Finance Committee Chair Judy Priestley (Ward 4) told EVM she thinks the city will continue to decline with the redevelopment of the property.

Priestly said she thinks the 80/20 model of new taxes is critical for the city to grow. “Without it [the redevelopment] we’re gonna lose the whole investment and who’s gonna want to come and redevelop that property?”

In an email to East Village Magazine (EVM) Councilperson Dennis Pfeiffer (Ward 8) wrote, “While I do believe this is a corporate handout and GM left us in a bad place, there aren’t any other options on the table to redevelop this site. It’s been dormant for a long time with no end in sight without this development.

“I wished that GM, now a very profitable company, would have stepped up and provided some support to Flint for this property beyond the bankruptcy plan in place, that doesn’t seem to be the case,” he said.

“While we will only recapture approximately 20% of taxes, that will be more than if the property remains vacant and abandoned. Beyond the property taxes, the city is also looking for job activities that would also provide income tax revenue to help offset any services the city would provide to the site in the future.

“While we don’t have official tenants released for the site we will (city) be also accommodating a potential large water customer that would provide a much needed boost to our water and waste funds.

“In regards to this being a succuss or failure as to over/under delivering I can’t answer that. Only time will tell, and unless we have exact metrics to measure this program before it is potentially implemented we may never know,” Pfeiffer concluded.

Editor’s note: EVM interviewed Tyler Rossmaessler, Executive Director of Flint & Genesee Economic Alliance for this article.

EVM Managing Editor Tom Travis can be reached at tomntravis@gmail.com

You must be logged in to post a comment.